General Rule for VAT treatment on Goods & Services

This is for Standard rated vat registered business (not flat rate or exempt and excluding activities under special vat rules) in the UK if they deal in

VAT treatment when a UK business dealing with UK based clients

| Goods | B2C or Individuals Persons (non-vat registered) | B2B (non-vat registered) | B2B (vat registered) |

| Sell to | Charge VAT | Charge VAT | Charge VAT |

| Buy from | No VAT | No VAT | Yes VAT reclaim |

| For Services (generally) | |||

| Provided by UK business | Charge VAT | Charge VAT | Charge VAT |

| Used by UK business | No VAT | No VAT | Yes VAT reclaim |

VAT treatment when a UK business dealing with Outside UK clients

| Goods | B2C or Individuals Persons (non-vat registered) | B2B (non-vat registered) | B2B (vat registered) |

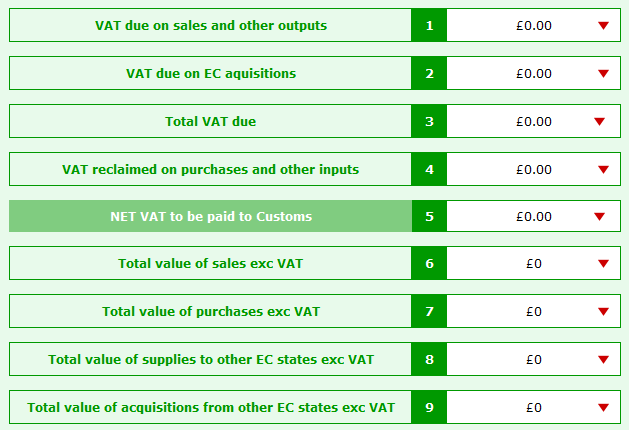

| Sell to | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 |

| Buy from | No VAT | Reverse Charge VAT Box 1,4 and 7 C79 reclaim or Postponed VAT Accounting (PVA) 0% or 20% | Reverse Charge VAT Box 1,4 and 7 C79 reclaim or Postponed VAT Accounting (PVA) 0% or 20% |

| For Services (generally) | |||

| Provided by UK business | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 |

| Used by UK business | Reverse Charge VAT Box 1,4 and 6 | Reverse Charge VAT Box 1,4, 6 and 7 | Reverse Charge VAT Box 1,4, 6 and 7 |