VAT Rules on Goods & Services

Overview of VAT place/time of supply, liability, exemptions and zero‑rating for SMEs.

Tax points Place of supply Liability

Understanding VAT on supplies

Place of supply

Determines which country’s VAT applies. Different rules for goods vs services, B2B vs B2C.

Time of supply (tax point)

Usually invoice date or payment date; special rules for continuous supplies and deposits.

Liability

Standard‑rated, reduced‑rate, zero‑rated or exempt. Mixed supplies may require apportionment.

| Type | Examples | Notes |

|---|---|---|

| Standard‑rated | Most goods & services | Charge VAT at standard rate; reclaim input VAT if allowable. |

| Reduced rate | Certain energy‑saving materials | Check HMRC guidance for eligibility. |

| Zero‑rated | Exports, children’s clothing, books | Sales are taxable at 0%; still reclaim input VAT. |

| Exempt | Finance, insurance, education (some) | No VAT to charge; input VAT may be restricted. |

This is for Standard rated vat registered business (not flat rate or exempt and excluding activities under special vat rules) in the UK if they deal in

VAT treatment when a UK business dealing with UK based clients

| Goods & Services (generally) |

B2C or Individuals Persons (non-vat registered) |

B2B (non-vat registered) | B2B (vat registered) |

|---|---|---|---|

| Sell to | Charge VAT | Charge VAT | Charge VAT |

| Buy from | No VAT | No VAT | Yes VAT reclaim |

VAT treatment when a UK business dealing with Outside UK clients

| Goods |

B2C or Individuals Persons (non-vat registered) |

B2B (non-vat registered) | B2B (vat registered) |

|---|---|---|---|

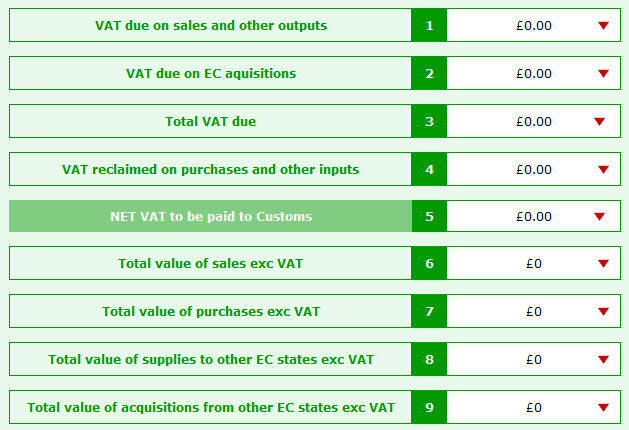

| Sell to | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 |

| Buy from | No VAT | Reverse Charge VAT Box 1,4 and 7 C79 reclaim or Postponed VAT Accounting (PVA) 0% or 20% |

Reverse Charge VAT Box 1,4 and 7 C79 reclaim or Postponed VAT Accounting (PVA) 0% or 20% |

For Services (generally)

| Goods |

B2C or Individuals Persons (non-vat registered) |

B2B (non-vat registered) | B2B (vat registered) |

|---|---|---|---|

| Provided by UK business | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 | Zero VAT, include in Box 6 |

| Used by UK business | Reverse Charge VAT Box 1,4 and 6 | Reverse Charge VAT Box 1,4 and 7 | Reverse Charge VAT Box 1,4 and 7 |